Zambia is once again experiencing crippling power outages with load-shedding of at least 6 hours a day in many parts of the country. The last time load-shedding was this heavy and this widespread was 2015. ZESCO, the electricity utility, says this year's load-shedding, just as the one in 2015, is due to low water levels at the country's main hydro power plants. Zambia generates most of its electricity from hydro sources.

The Zambian government is considering importing up to 300MW of emergency power from South Africa as a coping mechanism. Given the strained state of the country's finances, the Minister of Energy has suggested that electricity tariffs could be increased by as much as 75% to pay for the imports.

Research that my colleagues and I have conducted suggests that such a tariff increase would have grave consequences for the poor.

In 2017, ZESCO was allowed to implement a tariff hike of 75%. The motivation was that local tariffs were not cost reflective and needed to be adjusted upwards. Such an upward adjustment would make investments in electricity generation attractive for private sector players (the jury's still out on whether this has actually happened).

In a research paper that Mashekwa Maboshe, Akabondo Kabechani and I published this year in the journal Energy Policy, we simulated the likely impact of the 2017 tariff hike on different income groups in Zambia (published version here; ungated version here).

We found that the poorest 10% of Zambian households (the poorest decile) were likely to experience a 9.4% reduction in real household expenditure as a result of the tariff hike. In comparison, the real household expenditure decline for the richest 10% (richest decile), was only going to be 3.2%. In other words, the poorest 10% were going to see their real household expenditure decline at 3 times the rate that it would decline for the richest 10%.

An increase in electricity tariffs has the same impact on our incomes as inflation. Inflation, which is the general increase in prices, reduces the number of goods we can really (or actually) buy with our incomes. In other words, inflation reduces our real incomes or real expenditures. Electricity tariff increases have the same effect. Firstly, the tariff increase immediately affects the price of electricity (the direct effect). Second, because electricity is a vital input into the production of other goods, the prices of other goods also increase (the indirect effect). The poor are hardest hit because electricity and goods produced with electricity occupy bigger shares of their household budgets than the well-off.

Lastly, our simulations showed that an additional 100,000 people would become poor as a result of the tariff increase. This is because their real expenditures would fall below the poverty line as soon as electricity prices went up.

Our work shows that the burden of increased electricity tariffs in Zambia falls overwhelmingly on the poor. One hopes that Cabinet and the public will take this into consideration as they debate the next round of tariff increases.

(This piece has benefited from discussions with my coauthor Mashekwa Maboshe)

Wednesday 18 September 2019

Monday 16 September 2019

Yes, debt payments are high and rising

This past Friday president Lungu delivered his annual address to the National Assembly. The address is meant to provide policy guidance for the year ahead as well as signalling the start of a new session of parliament. One of the most striking paragraphs from the president's address to the House was this one:

I initially thought that the president's speech writers had gotten their facts wrong around debt expenditure -- surely our debt service payments weren't as high as the president was making them out to be?

I was compelled to factcheck this statement all the while hoping against hope that the president, or his speechwriters, were wrong.

The most sensible way of fact checking this is to compare the president's statement with the official position on debt expenditure as contained in the 2019 Budget Address. According to the budget, the total amount of money set aside for debt service payments for 2019 was K24billion (K9billion for domestic debt and K15billion for external debt). Total expenditure for the budget as a whole was K87billion. This gives a debt expenditure share of 28%.

So did the president exaggerate the budget's debt share by a whole 12 percentage points? Not exactly.

Recall that in August of this year, the new Minister of Finance Dr. Bwalya Ng'andu asked parliament to approve a supplementary budget of K9.8billion. Dr. Ng'andu wanted the extra money to mostly pay for unexpected increases in debt service payments as a result of a weaker Kwacha among other reasons. Adding the amount that Dr. Bwalya asked for brings the total debt expenditure for 2019 to K34billion, representing a budget share of 35%. A number that's very close to what the president said in the National Assembly. (I invite better informed readers to figure out what might account for the 5 percentage points difference between what the president said and what I have estimated here).

Have we always spent this much of our budget on servicing debt? Figure 1 below shows that debt service payments were only 9% of the budget in 2009 and began to grow at alarming rates starting about 2015. By 2019, the debt service share in the budget was 28% (35% if you add the supplementary expenditure). So the share of the national budget dedicated to debt has grown by over 200% from 2009 to 2019 and is now at least a third of the budget if not more!

It's also interesting to figure out what the structure of debt payments has looked like over this period. In other words, what has been the share due to domestic debt payments versus external debt payments?

Figure 2 provides this split. From 2009, the external debt expenditure share in the budget was very small (at 2.4%) and less than the domestic share (at 6.4%). However, beginning in about 2013, the external debt share began to increase rapidly so that by 2019, the budget was spending 17% on servicing external debt and spending 10% on domestic debt service. And servicing external debt is a Herculean effort because you need to use precious, and hard to earn, foreign currency to do it.

Finally, it's worth comparing the budget's expenditure on debt payments versus expenditure on what most citizens would deem as desirable expenditures over this period.

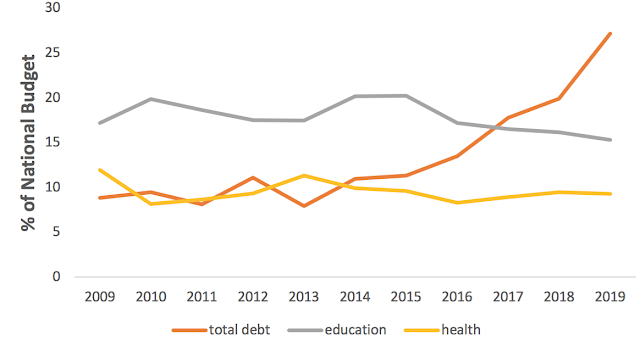

Figure 3 provides this information. In 2009, the shares of the budget dedicated to education (17%) and health (12%) were both greater than the share allocated to total debt service (9%). Today, the opposite is true -- the total debt share in the budget far exceeds the shares allocated to education and health combined!

A closer inspection of Figure 3 suggests that the health share, for example, begins to decline around about the time that the total debt share begins to explode (the response in the education share is a little bit delayed). Any student of social sciences, however, knows that correlation is never proof of causation -- in other words, the declines in the health and education shares may have nothing to do with the increase in the total debt share even though they both happen at the same time.

We do, however, have some very good scholarly evidence that the relationship depicted in Figure 3 is likely to be causal especially in sub-Saharan Africa. In other words, the declines in the health and education shares in Figure 3 are very likely caused by increases in debt service payments. And this is likely to get worse as debt service payments continue to occupy ever bigger chunks of the national budget going forward.

Our non-discretionary expenditure, which comprises personnel emoluments and debt stands at 50.1% and 40% respectively, giving a total of 90.1% of our annual budget. This leaves the discretionary expenditure amount to stand at 9.9% of our annual budget. This Mr. Speaker is an alarming ratio.

I initially thought that the president's speech writers had gotten their facts wrong around debt expenditure -- surely our debt service payments weren't as high as the president was making them out to be?

I was compelled to factcheck this statement all the while hoping against hope that the president, or his speechwriters, were wrong.

The most sensible way of fact checking this is to compare the president's statement with the official position on debt expenditure as contained in the 2019 Budget Address. According to the budget, the total amount of money set aside for debt service payments for 2019 was K24billion (K9billion for domestic debt and K15billion for external debt). Total expenditure for the budget as a whole was K87billion. This gives a debt expenditure share of 28%.

So did the president exaggerate the budget's debt share by a whole 12 percentage points? Not exactly.

Recall that in August of this year, the new Minister of Finance Dr. Bwalya Ng'andu asked parliament to approve a supplementary budget of K9.8billion. Dr. Ng'andu wanted the extra money to mostly pay for unexpected increases in debt service payments as a result of a weaker Kwacha among other reasons. Adding the amount that Dr. Bwalya asked for brings the total debt expenditure for 2019 to K34billion, representing a budget share of 35%. A number that's very close to what the president said in the National Assembly. (I invite better informed readers to figure out what might account for the 5 percentage points difference between what the president said and what I have estimated here).

Have we always spent this much of our budget on servicing debt? Figure 1 below shows that debt service payments were only 9% of the budget in 2009 and began to grow at alarming rates starting about 2015. By 2019, the debt service share in the budget was 28% (35% if you add the supplementary expenditure). So the share of the national budget dedicated to debt has grown by over 200% from 2009 to 2019 and is now at least a third of the budget if not more!

|

| Figure 1: Total Debt Service Share in the National Budget Source: Various National Budgets |

It's also interesting to figure out what the structure of debt payments has looked like over this period. In other words, what has been the share due to domestic debt payments versus external debt payments?

Figure 2 provides this split. From 2009, the external debt expenditure share in the budget was very small (at 2.4%) and less than the domestic share (at 6.4%). However, beginning in about 2013, the external debt share began to increase rapidly so that by 2019, the budget was spending 17% on servicing external debt and spending 10% on domestic debt service. And servicing external debt is a Herculean effort because you need to use precious, and hard to earn, foreign currency to do it.

|

| Figure 2: Total, Domestic and External Debt Shares in National Budget Source: Various National Budgets |

Finally, it's worth comparing the budget's expenditure on debt payments versus expenditure on what most citizens would deem as desirable expenditures over this period.

Figure 3 provides this information. In 2009, the shares of the budget dedicated to education (17%) and health (12%) were both greater than the share allocated to total debt service (9%). Today, the opposite is true -- the total debt share in the budget far exceeds the shares allocated to education and health combined!

|

| Figure 3: Total Debt Share, Education Share and Health Share in National Budget Source: Various National Budgets |

A closer inspection of Figure 3 suggests that the health share, for example, begins to decline around about the time that the total debt share begins to explode (the response in the education share is a little bit delayed). Any student of social sciences, however, knows that correlation is never proof of causation -- in other words, the declines in the health and education shares may have nothing to do with the increase in the total debt share even though they both happen at the same time.

We do, however, have some very good scholarly evidence that the relationship depicted in Figure 3 is likely to be causal especially in sub-Saharan Africa. In other words, the declines in the health and education shares in Figure 3 are very likely caused by increases in debt service payments. And this is likely to get worse as debt service payments continue to occupy ever bigger chunks of the national budget going forward.

Subscribe to:

Posts (Atom)